Scientists from the University of Chicago have demonstrated that large language models can conduct financial statement analysis of companies with greater accuracy than professional analysts. These research findings could impact the future of financial analysis and consulting industries.

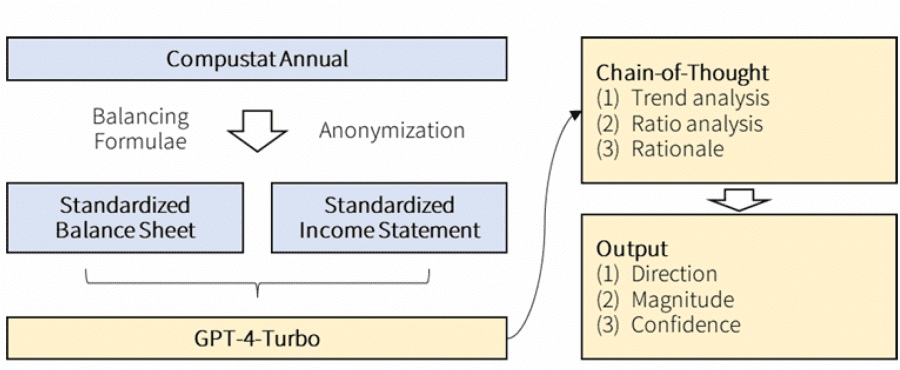

Mathematical computations followed by interpretation and decision-making pose one of the most challenging tasks for large language models. Researchers tested GPT-4 on the task of analyzing corporate financial statements to predict future profit growth. Given only standardized, anonymized balance sheets and income statements devoid of any textual context, GPT-4 outperformed human analysts.

Anonymized standardized financial statements served as the input data. The model’s task was to predict the direction of company revenue changes, their magnitude, and to determine the lower and upper bounds of the forecast.

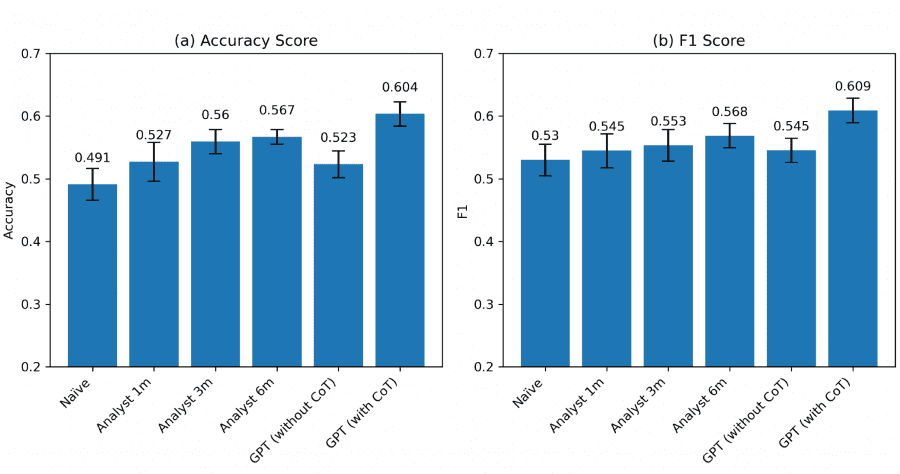

Scientists further trained GPT-4 to replicate the thought process of a financial analyst, identify trends, calculate ratios, and summarize information to generate forecasts. The study revealed that OpenAI’s GPT-4 outperformed analysts in predicting corporate revenues, achieving an accuracy of 60% compared to the specialists’ 53-57%.

Researchers believe the model’s advantage comes from its extensive knowledge base and its ability to recognize patterns and business concepts, allowing it to reason intuitively even with incomplete information.